Nearly a decade after the 2016 referendum, Brexit continues to reshape how people buy, sell, and invest in property across the UK and Europe. The aftershocks remain significant.

Market Uncertainty and Price Fluctuations

Economic uncertainty following Brexit created hesitation amongst buyers, sellers, and investors. Unclear trade agreements and shifting political landscapes led to market stagnation, followed by unpredictable price surges. London and the South East experienced temporary price dips, whilst other regions attracted buyers seeking better value outside the capital. The market has become more regionally diverse, with local economic conditions now playing a larger role than ever before.

Regional Property Market Shifts

London & South East – Temporary price dips in high-end markets as foreign investment decreased.

Northern England – Increased demand as buyers sought better value for money.

Scotland & Wales – Emerging opportunities with growing domestic buyer interest

Changing Demand from EU Buyers

Before Brexit, the UK property market attracted steady investment from France, Germany, Italy, and Spain. New immigration and residency rules changed everything.

Before Brexit

- Open access for EU investors

- Simple residency procedures

- High competition in prime London markets

After Brexit

- Complex visa requirements

- Reduced foreign buyer competition

- New opportunities for domestic purchasers

Financing and Currency Challenges

Currency Volatility – A weaker pound made UK real estate more affordable for some international buyers, but increased volatility raised investment risks significantly.

Mortgage Complications – UK citizens buying in the EU face stricter lending policies from European banks, with many demanding larger deposits and imposing tougher conditions on British nationals.

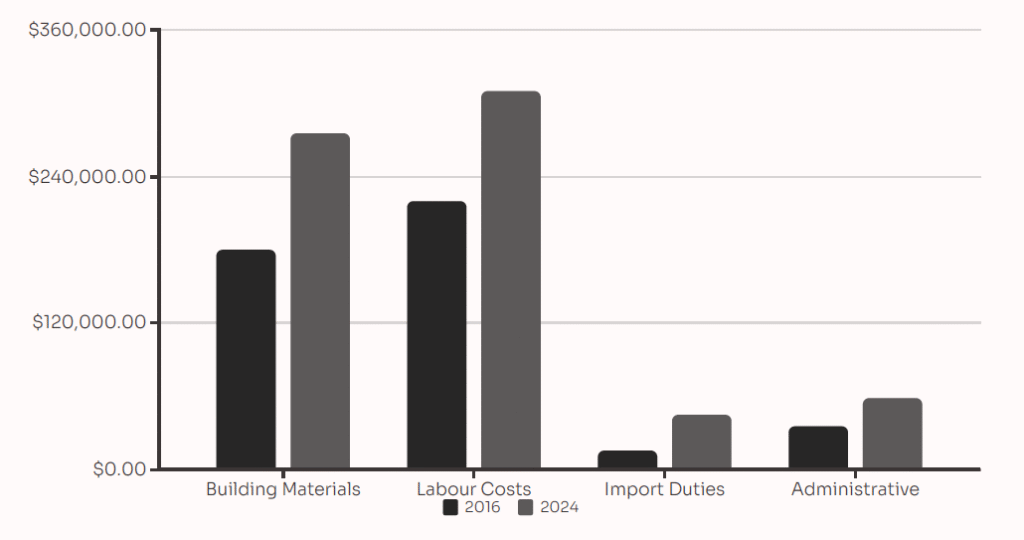

Supply Chain and Construction Cost Pressures

New Customs Checks – Delays at borders disrupting material deliveries and increasing administrative costs for developers.

Import Tariffs – Additional charges on essential building materials driving up overall construction expenses

Reduced EU Labour Access – Skilled worker shortages slowing down projects and increasing wage costs across the industry

Higher Property Prices – Supply-side strain contributing to increased property prices and rental rates, particularly in shortage areas

The Cost Impact on Development

Development costs have risen significantly across all categories, with import duties tripling and labour costs increasing by 40% since the referendum.

Legal and Residency Barriers

New Complications

- Visa restrictions limiting stays in EU countries for British citizens

- Complex visa pathways for EU nationals in the UK

- Increased legal fees and registration costs

- More complex tax implications for cross-border purchases

Adapting to the New Normal

Market Resilience – Investors and homeowners are successfully adapting to new regulations and financial realities

Domestic Focus – Shift toward long-term stability with buyers prioritising UK properties over abroad

Innovation – Developers exploring innovative financing models and sustainability-focused projects

Navigating the Post-Brexit Property Landscape

Key Takeaways

Brexit has undoubtedly introduced new hurdles – from financing complications to construction cost increases and international purchase barriers. Yet opportunities exist for those who understand the new dynamics.

Success requires not only financial readiness but strategic awareness of how political and economic shifts continue to influence the market.

- Stay Informed – Keep abreast of regulatory changes and market trends

- Think Long-Term – Focus on sustainable investment strategies

- Seek Expert Advice – Navigate complexity with professional guidance

Source: www.emlinbusinessconsulting.com